F1 103A Interest on penalties. Payment For Interest On Judgement Amounts.

A penalty under any of the provisions of F2 Part II IV or VA or this Part of this Act F3 other than section 98C F4 or Schedule 18 to the Finance Act 1998 shall carry interest at the rate applicable under section 178 of the Finance Act 1989 from the date on which it becomes due and payable until.

. Payment For Court Fee. Penalty Payment For Section 108. Payment of Estimated Income Tax Instalments After Deadline For Business Income Type of Offences Provisions Under ITA 1967 Penalties.

Penalty Payment For Section 107C9 107B3 11. Payment For Interest On Judgement Amounts. 1 Every company trust body or co-operative society shall for each year of assessment furnish to the Director General an estimate of its tax payable.

Penalty Payment For Section 103A 103. Penalty Payment For Section 103A 103. Payment For Court Fee.

Employment Rights Act 1996 Section 103A is up to date with all changes known to be in force on or before 29 July 2022. Payment For Interest On Judgement Amounts. Penalty Payment For Section 108.

Payment For Court Fee. 2 Except as provided in subsection 4a and subsection 4A the estimate of tax payable for a year of assessment shall be made in the. Penalty Payment For Section 107C10 107B4 12.

Interest Payment On Judgement Amounts. Payment For Interest On Judgement Amounts. 25 rows Penalty Payment For Section 103A 103.

Estimate of tax payable and payment by instalments for companies. Penalty Payment For Section 108. Penalty Payment For Section 103A 103.

Penalty Payment For Section 107C10 107B4 12. Penalty Payment For Section 107C9 CP204 estimation not paid 107B3 11. 2 Except as provided in subsection 3 tax payable under an assessment for a.

INCOME CORPORATION AND CAPITAL GAINS TAXES. CCH - British Tax Legislation. Section 107B3 10 increment from the tax payable.

Penalty Payment For Section 108. Penalty Payment For Composite. Penalty Payment For Section 107C9 107B3 7.

Penalty Payment For Section 107C9 107B3 12. 1A Where an assessment or additional assessment has been made under section 91A the tax or. Revised legislation carried on this site may not be fully up to date.

Payment of Estimated Income Tax instalments after deadline For Business Income. Section 103A formerly read. Penalty Payment For Section 107C10 107B4 8.

Deleted by Act A1151 History Section 103A deleted by Act A1151 of 2002 s16 with effect from year of assessment 2004. Changes that have been made appear in the content and are referenced with annotations. Section 1033 10 increment from the tax payable.

Penalty Payment For Section 107C9 107B3 11. There are changes that may be brought into force at a future date. Payment For Court Fee.

Penalty Payment For Section 103A 103. Penalty Payment For Section 107C10 107B4 13. Penalty Payment For Section 103A 103.

Instalment Payment Approved by Collection Unit. 1 This section shall apply only to companies. Penalty Payment Under Section 107C9 107B3 9.

Payment of tax by companies deleted by Act A1151. Instalment Payment Approved by Audit Unit. Penalty Payment For Composite.

Penalty Payment For Section 108. Penalty Payment For Section 107C9 107B3 11. Penalty Payment For Section 107C9 107B3 11.

Penalty Payment For Composite. Payment For Court Fee. Payment For Court Fee.

PART X PENALTIES ETC. Penalty Payment For Section 108. Penalty Payment For Composite.

Penalty Payment For Section 107C10 CP204 under estimation by 30 107B4 12. Penalty Payment For Section 107C10 107B4 12. Penalty Payment For Composite.

Changes to Legislation. TAXES MANAGEMENT ACT 1970. Payment For Interest On Judgement Amounts.

1 Except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not that person appeals against the assessment. Penalty Payment For Section 103A 103 Payment Section 108 Penalty Payment For Section 108 Penalty Payment For Composite Penalty Payment For Section 107C9 107B3 Penalty Payment For Section 107C10 107B4 Payment For Court Fee Payment For Interest On Judgement Amounts Installment Payment Approved by Audit Installment Payment Approved. A Commercial Storefront in violation of this Section 103A5 including Sections 103A51-103A57 is deemed to be a public nuisance and subject to enforcement by the Department and penalties under Sections 102A and 103A and Section 110A Table 1A-K of this Code or other applicable sections of the Municipal Code.

Penalty Payment For Composite Assessment. Penalty Payment For Composite. 93 103A Interest on penalties.

Penalty Payment For Section 108. Penalty Payment For Composite. Penalty Payment For Section 103A 103.

Penalty Payment Under Section 107C10 107B4 10. Payment for Section 108. Moved Temporarily The document has moved here.

Actual tax 30 higher than the. Penalty Payment For Section 103A 103 tax not paid 7. Penalty Payment For Section 107C10 107B4 12.

Payment For Interest On Judgement. Payment Section 108. 6 150 Penalty Payment For Section 103A 103 7 151 Payment Section 108 8 152 Penalty Payment For Section 108 9 153 Penalty Payment For Composite 10 154 Penalty Payment For Section 107C9 107B3 11 155 Penalty Payment For Section 107C10 107B4 12 156 Payment For Court Fee 13 157 Payment For Interest On Judgement Amounts 14 158.

Akuyaku Reijou Wa Danna Sama Wo Yasesasetai

Moto Guzzi Motorcycles Scooters For Sale Ebay

Lightplane Panels Elevator Interior Paneling Led Panel

Debaprasad Bandyopad On Twitter

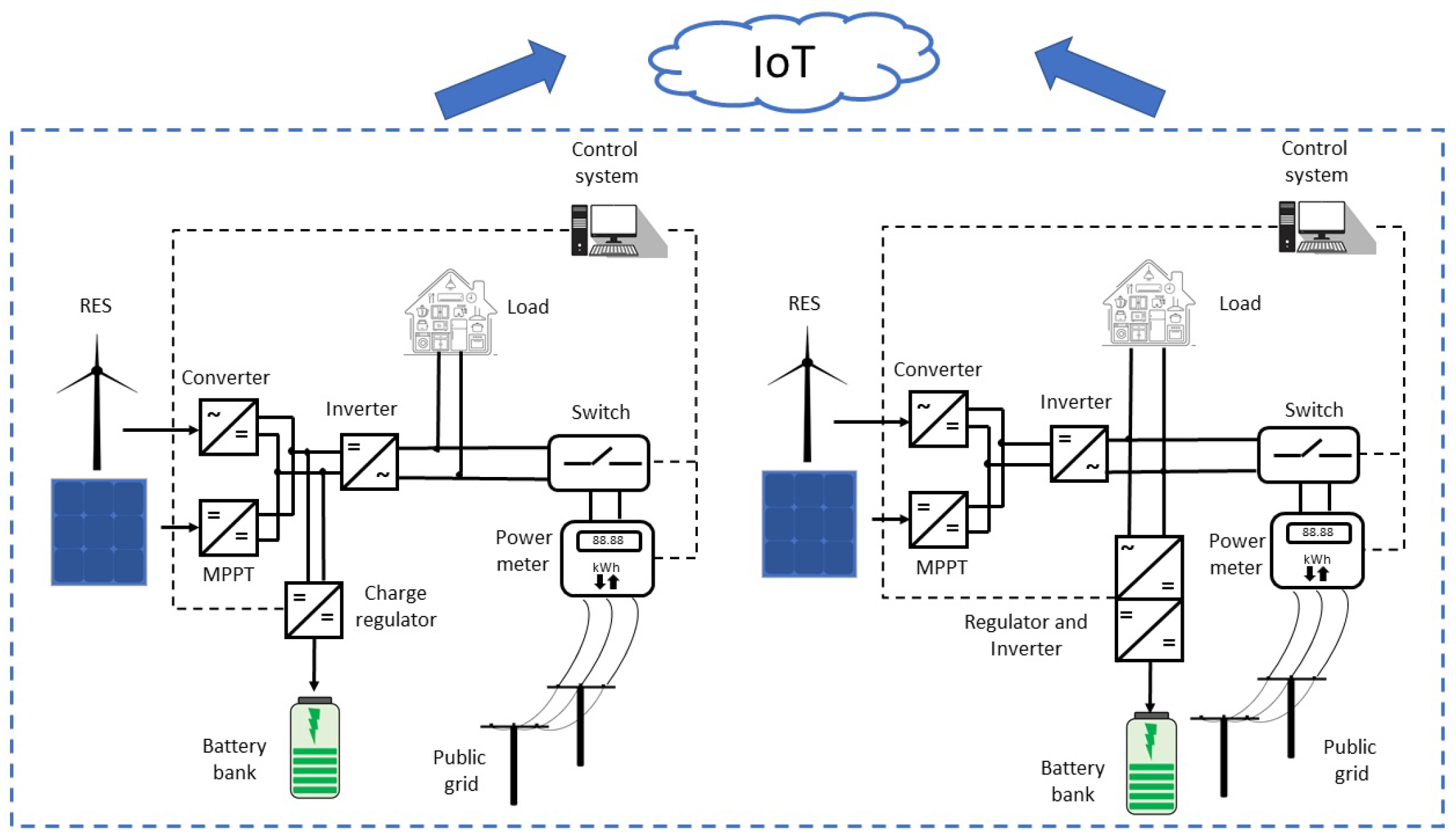

Energies Free Full Text Towards Optimal Management In Microgrids An Overview Html

Dawah Institute Building Resilience Against Intra Faith And Interfaith Extremism Through The Seerah

More Good Tax Form Design Irs Forms Tax Forms Form Design

Black Female Therapists On Instagram Though Some May Think That A Boundary Is A Grudge The Truth Is Boundaries Are A Form Of Self Care Having Healthy Boundaries Means

Robinson Crusoe By Daniel Defoe Rare 1920 Art Type Edition

Transformers Universe Picture Pop Up

103 Tiny Harry Potter Tattoo Ideas That Any Witch Or Wizard Will Love

103 Tiny Harry Potter Tattoo Ideas That Any Witch Or Wizard Will Love